I have bad news.

If you had $100 sitting in a savings account for the last year, it’s now worth only about $94. You’ve lost just over six percent of your purchasing power. Think about that. The number might be the same, but the amount you can buy with it is less. A lot less.

I personally believe its much higher than that.

You’re already seeing the effects of this—I know you are. It’s playing out at the gas pump, where prices climb every week, at at the grocery store, where basic goods have jumped in price seemingly overnight. It’s impossible to not notice.

We’re not even talking about rising prices for rent, used cars, heating, and more. You’ll find inflation there too. Loads of it.

A few days ago, I visited my esthetician. He’s given me chemical peels every few months for the last seven years, and helps make sure my acne-prone skin stays in check. “I’m so freaked out about inflation,” he told me. “I can’t believe how expensive things are getting.”

He’s right.

And all of this bad news means—you can’t save right now. You can’t put money aside in a standard saving account or money-market fund, adding a few bucks here and there each month until you reach your goals. Well, you can… but it won’t help you like it used to do.

This “basic savings advice” worked better when the economy was stable and inflation was more like 2 percent. But when inflation reaches numbers like the ones just reported, it acts as a destabilizing force. It has major ramifications, the first of which happens through simple math. Putting money into a standard savings account now will just cause you to lose money as a result of a decrease in purchasing power.

Worse, the inflation rate shows no signs of slowing down and the folks in Washington don’t appear motivated to get a hold of it.

A year from now, a simple saver will be worse off financially.

So what do you do?

You have to invest. And you have to find a vehicle with a good shot of bringing you a return above six percent in order for you to keep your purchasing power in tact. Stocks are a great way to do this, but crypto performs even better.

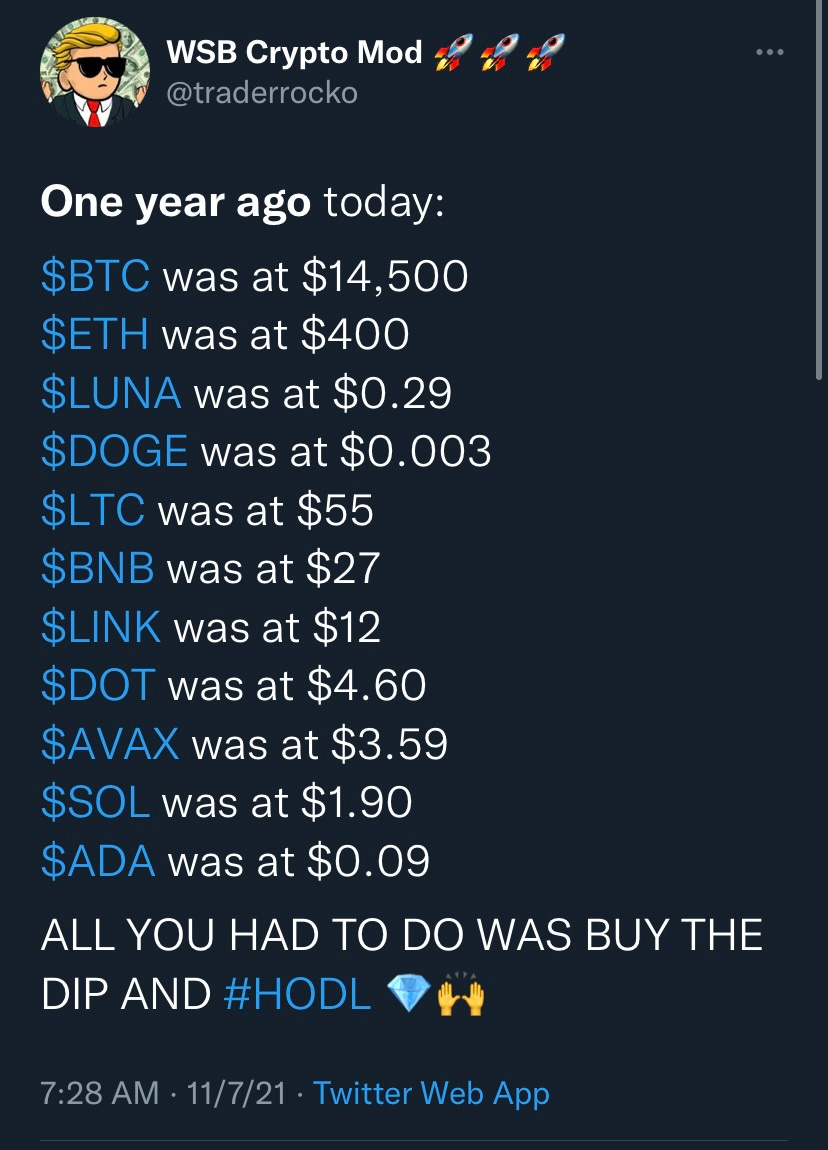

Don’t take it from me. Look at the historical prices of some of the best known assets in the sector. It’s easy to find these—crypto folks love to shout it. Here’s a recent post on Twitter:

Now, take a moment and look up the price of any of these cryptocurrencies today. Wow, right? That return beats inflation. No question. It’s not even a race. Investing in crypto is a risky and aggressive move, but when the economic threats abound, sometimes the calculated risk is the best decision you can make.

There’s a reason big money is getting into the sector now.

You don’t have to be a genius to ensure decent returns. Just buy and hold. Pick two or three you like (I recommend at least one of them being Bitcoin) and let it ride. Give it a few weeks or months, and see how you feel.

You owe it to your future self.

The Crypto Connection is for entertainment purposes only and is not meant to be financial advice. Please do your own research before investing in any asset class. Sara Celi is not a financial advisor, and holds several cryptocurrencies. To purchase her books on Amazon, please click here.