Some Thoughts on the FTX Collapse

The meltdown will have huge consequences, and things may get worse

Dear subscribers,

Wow. What a week it has been.

Like many, I’m in shock. Stunned. Blown away by the revelation of FTX as little more a criminal enterprise. I didn’t see this one coming. Indeed, I don’t know anyone who did.

If you’re just catching up (or haven’t heard), FTX is insolvent, all funds left on every platform of that exchange are gone, and Sam Bankman-Fried, the CEO, is somewhere—maybe in custody in the Bahamas, maybe in a country without an extradition treat with the US. Nobody is exactly sure, and conspiracy theories are running through the internet like the fallout from a nuclear bomb.

That’s the condensed version of this last week’s major events.

In sum… billions of dollars in investor money has disappeared overnight. A lot of people are really hurt, and some have been financially ruined. This collapse is big.

Very big.

FTX was supposed to be different. It was supposed to be legit. The company seemed to be making all the right moves that correlated with tremendous overnight growth and investment by some of the biggest names out there, some of the most seasoned players on Wall Street and in finance.

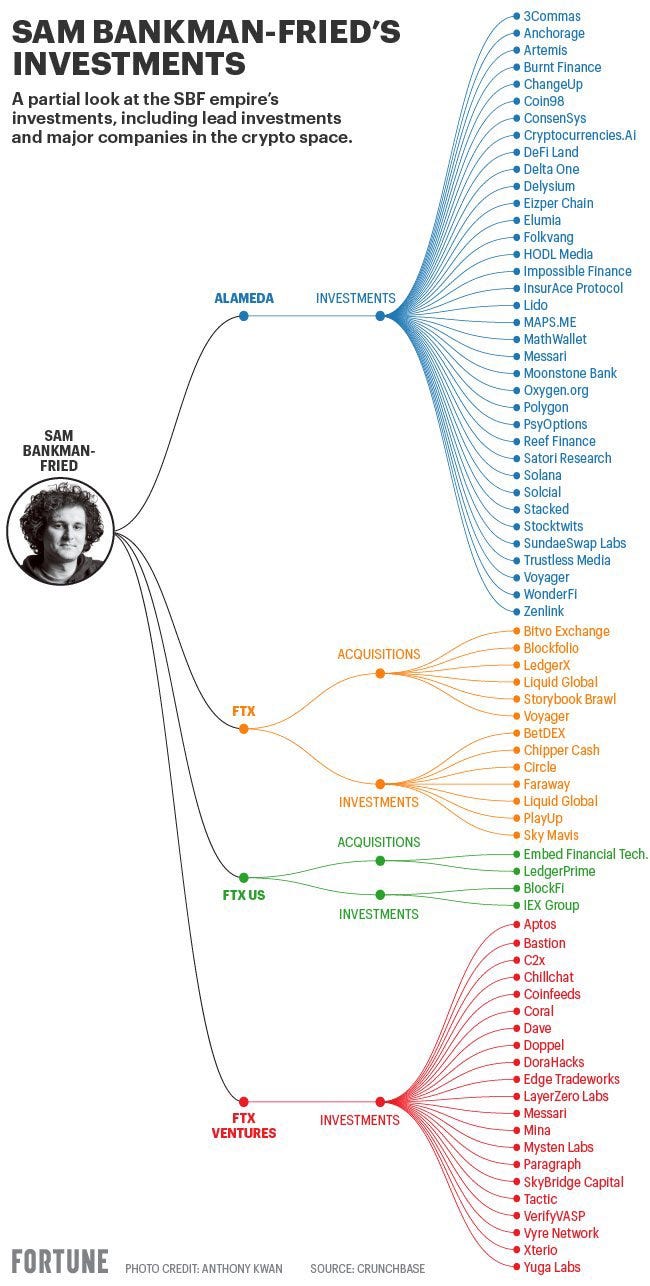

Sam Bankman-Fried spent tons of time in Washington, DC working with lawmakers “on behalf of the industry” and made friends with plenty of move and shakers. He came from the “right” school, and his family knew the “right people”. FTX purchased naming rights on the old American Airlines Arena in Miami and ran a huge ad campaign during the Super Bowl in February. SBF donated millions to the Democratic party and was a huge funder of campaigns in the recent midterm election.

None of that… or anything else about FTX… mattered. A scam is a scam, and it’s becoming pretty clear that FTX was exactly that. It operated as an exchange, but it was a fraud.

And that fraud has now been exposed.

What happens next?

I don’t know. I wouldn’t say crypto is mortally wounded from this, but I would say it is severely injured. The washout from this will have lasting effects. Plenty of people are giving the whole sector the side eye, and the truth is… they should.

They absolutely should.

If you’re not questioning things after this moment, then you likely aren’t paying close enough attention. A cleanup is required for the crypto industry, and it is required now.

So where does that leave this newsletter?

Well… still here. I’ve thought long and hard about this after the last few days, and I’m not leaving. I still think Bitcoin is an important asset, and that cryptocurrency in general has a lot of potential as a new place for investment.

Emphasis on the word potential.

As I have said before, cryptocurrency is highly volatile and speculative. It comes with risk that isn’t seen in other asset classes, and that might not be the best idea for everyone. You shouldn’t put money into this group of investments until you are absolutely certain you can stomach the exposure.

And there are a few other best practices that are worth reviewing at a time like this:

Don’t leave money on a cryptocurrency exchange that you aren’t willing to lose

Learn to self-custody your assets

Trust, but verify

Don’t expect a bailout if you lose your funds

Research all assets before buying

Understand that scammers are everywhere

Don’t let greed make your decisions for you

Diversify your investments so that you maintain positions outside of crypto (such as real estate, stocks, bonds, cash, fine art, etc.)

Stay humble and be wary of those who are not

Going forward, this newsletter is going to become Bitcoin first. Meaning… I’m going to focus primarily on that asset. Other cryptos may be mentioned, but I’m going to dial back my analysis of those.

Why?

Because right now, Bitcoin is the only thing that holds up to the deepest scrutiny. Other cryptocurrencies show promise, but Bitcoin has proven its value over time, and remains a decentralized investment. Investors can truly take hold of their Bitcoin if they do things right. The network has never been hacked. It is peer-to-peer.

So, while I am not a Bitcoin maximalist, I am a Bitcoin firstalist (I made that word up).

And… I want to be transparent about something else.

This newsletter is not funded or sponsored by any third party. None. The only funding comes from paid subscriptions, and I have no plans to change that. Speaking of which… if you are interested in seeing this newsletter grow, feel free to subscribe now:

Again… I will not be accepting any third party sponsorships for this newsletter. At all. I want to maintain the independent nature of this newsletter, and third party investment prevents that.

Onward!

Sincerely,

Sara

The Crypto Connection is for entertainment purposes only and is not meant to be financial advice. Please do your own research before investing in any asset class. Sara Celi is not a financial advisor, and holds several cryptocurrencies. To purchase her books on Amazon, please click here.