How Does It All Work, Anyway?

Plus, it's "rug" season, and did those Super Bowl ads change anyone's mind?

Many of us are new to this space.

And that’s fine—cryptocurrency and the tech that surrounds are still pretty new too, having only legitimized in the last decade. Crypto is still a confusing technology to understand, even for people who embraced it from the beginning.

A lot of people are having trouble making the leap.

A friend mentioned that the other day at lunch. “I just don’t get it,” she said with a frown. “How do the transactions work?”

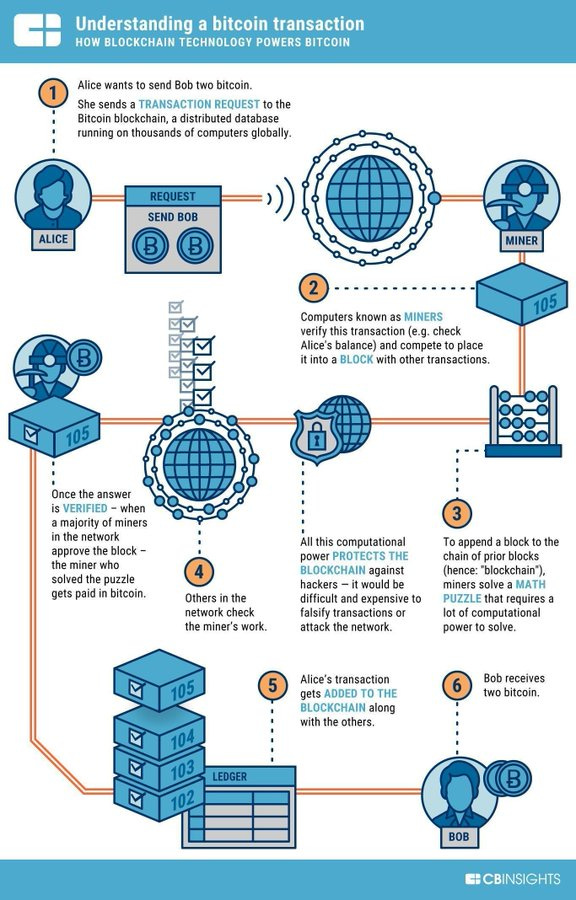

I tried explaining it, and gave up after cobbling together a few sentences. Luckily, I found an infographic I’m sharing with you today. This one focuses exclusively on Bitcoin, but once you get how that network operates, you can use it as the basis for understanding other blockchains.

Without further ado:

Seeing the process in a graphic like this really helped me visualize how Bitcoin’s blockchain worked. I hope it will help you too.

The more you know…

Plus…

Sun’s out… rug’s out.

What do I mean by this? The first two months of 2022 have seen their faire share of major rug pulls. In crypto investing, a rug pull is a scenario where crypto developers abandon a project without warning in order to run away with investor funds. “Pulling a rug” leaves the asset valueless, and the scam often happens through liquidity stealing, limiting sell orders, and dumping tokens. Now that NFTs are going mainstream, rug pulls happen with those assets too.

And no, this stuff isn’t totally illegal.

In the last few weeks, there have been a number of rug pulls that have shocked various parts of the crypto community. Often, these scams involved tokens built on top of marquee chains like Ethereum, Cardano, Solana, or Algorand, and have not the layer one assets themselves.

So how do you avoid getting “rugged”?

It can be hard, but here are a few things to watch out for when investing in any “new” tokens or NFT projects:

Are the developers anonymous? Outside of Bitcoin, this can be a huge red flag. No name, no accountability.

No liquidity locked? That could give the developers an easy way to drop the token once they know the price will bring them a sizeable profit.

Are the yields too high to be true? A super high yield can sometimes mean shadiness is afoot.

Is the price skyrocketing but the number of holders is not? That can be a warning sign that manipulation is ahead. Beware of the “pump” before the “dump”.

No external audit? Audits promote transparency. You need that before making any investment, crypto or not.

As always, only invest what you can afford to lose. Crypto is a risky game, and rug pulls can be huge hazards. Always keep your wits about you before you throw down your money, and beware of the coins and NFT projects being shilled by celebrities and influencers. Not all those folks have good intentions. You want to check out what is behind all the hype.

Finally…

The impact of all those Super Bowl crypto commercials remains to be seen, but at least one of them triggered an immediate reaction. Coinbase’s bouncing QR code ad was such a hit that the exchange went down for a short period.

BlockFi has agreed to a $100 million settlement with the SEC.

Whatever you think of people who mine Bitcoin, some folks are doing it in very interesting ways.

Trudeau’s Canadian government has invoked that nation’s Emergencies Act in response to ongoing protests. Trudeau says an expansion of the act will include cryptocurrency.

The Crypto Connection is for entertainment purposes only and is not meant to be financial advice. Please do your own research before investing in any asset class. Sara Celi is not a financial advisor, and holds several cryptocurrencies. To purchase her books on Amazon, please click here.