Crypto 101: What is TVL?

Plus, a few headlines to keep on your radar...

Hang around the crypto space long enough, and you see one term come up time and again.

TVL.

The anacronym stands for total value locked, and like many other terms has been shortened by internet culture for convenience and time. TVL just sounds cooler.

When it comes to crypto, total value locked refers to the overall value of crypto assets that are deposited into a decentralized finance (defi) protocol. Most of the time, that includes staking, lending, and liquidity pools. The TVL measurement refers to the current value of those funds at a given moment, and is subject to change based on the dollar value of those investments.

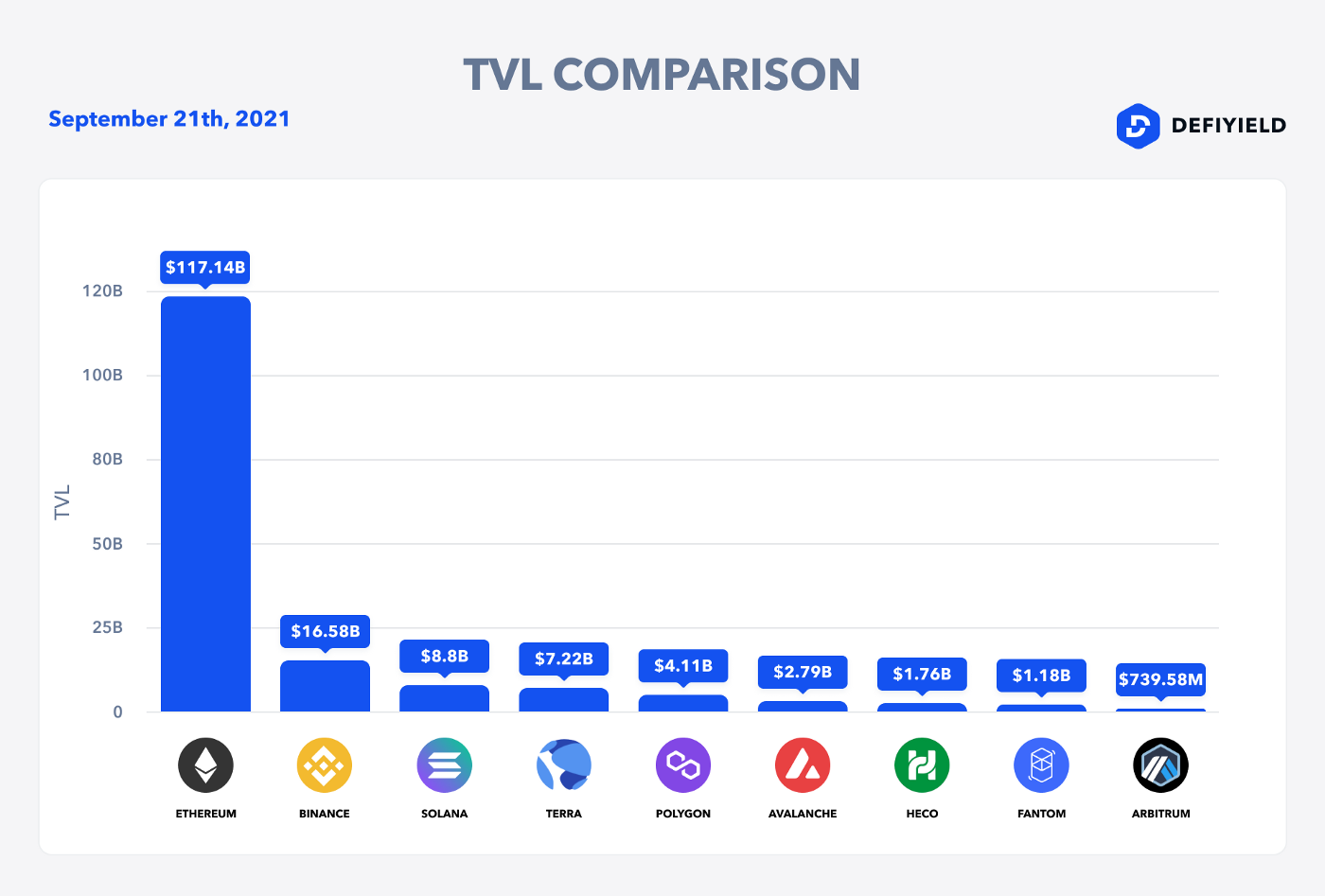

Right now, Ethereum has the largest TVL, making up more than half the market. Just to be clear, the latest TVL for the totality of the sector has passed $200 billion. And Bitcoin is not included in this measurement, as the protocol for Bitcoin is different.

When looking at a project, coin, or token for investment, taking a glance at the TVL can be an important metric for investors. It can tell you the health of the project, and all you to determine if a project is overvalued or undervalued. Many people compare TVL to market cap, and that ratio helps them make sound decisions.

Just like any investment, you want to have as much information as possible! The more you know…

Plus…

Bored Ape Yacht Club’s ecosystem continue to grow. Think you’ve seen the best of this project? Think again…

Time Mag profiled Vitalik Buterin in an… interesting interview. Check it out for yourself.

Just like other investments, make sure you have a plan for your crypto investments when you die.

The Crypto Connection is for entertainment purposes only and is not meant to be financial advice. Please do your own research before investing in any asset class. Sara Celi is not a financial advisor, and holds several cryptocurrencies. To purchase her books on Amazon, please click here.